Snowball democratizes investment into the world’s leading cryptocurrency funds, by using Smart Crypto Investment Automation or SCIA, to deploy and rebalance customer capital into regulatory-approved cryptocurrency indexes.

Snowball approached us to develop and compose its project whitepaper. With limited documentation and a fast-changing thesis, we sat down with Snowball’s founder, Parul, and worked through a series of questions, discussions and dialog to hone in on the founder’s vision.

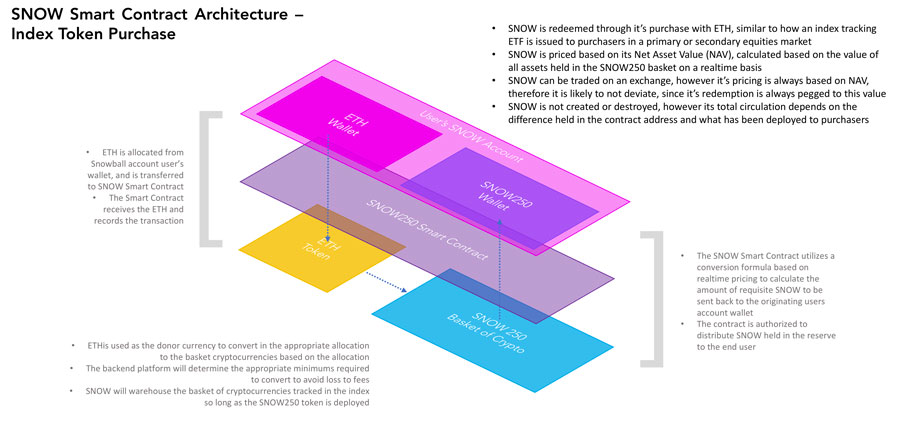

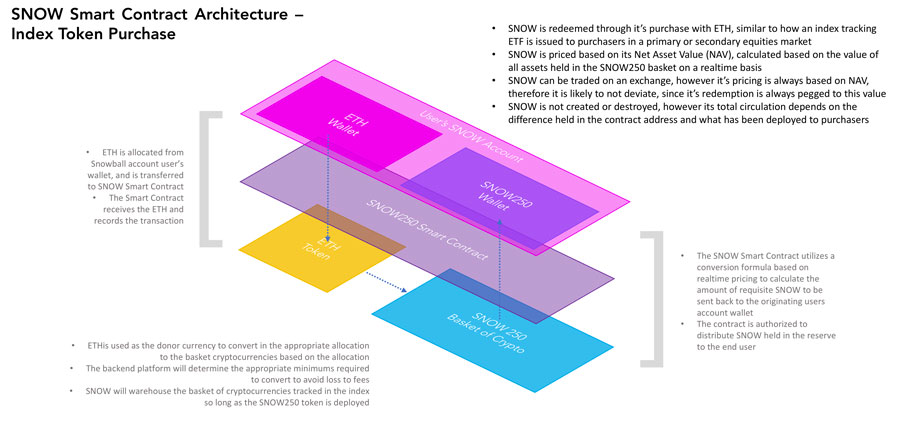

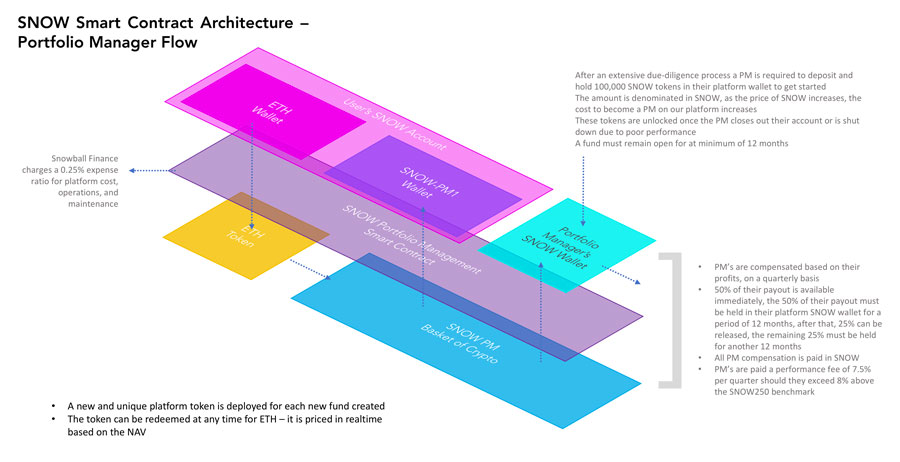

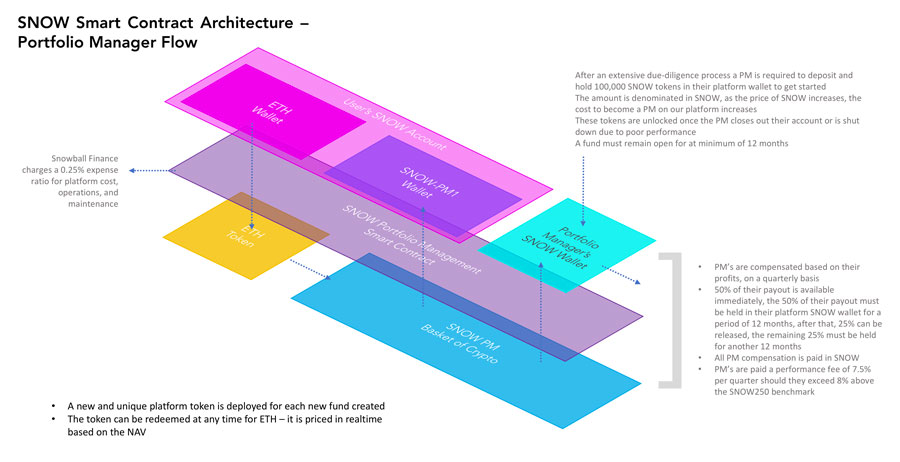

At the request of the client, we first approached the model from a token economics standpoint. Together, we wanted to explore whether a multi-faceted Smart Contract architecture could be used to convert a donor currency like ETH, to a multi-currency index, that was denominated in SNOW, the platform’s native cryptographic token. In addition to this, we were tasked with linking portfolio manager performance with token payouts.

Leveraging our knowledge of finance and Smart Contract architecture, we produced a series of SC approaches to solve the current model using a native token ecosystem.

Our solution to Snowball’s unique requirements was to build a Smart Contract that could deploy or hold SNOW tokens based on the behaviors of users on the platform. Specifically, as investors buy into a specific Snowball Index, the SC deploys an equivalent amount of SNOW tokens as a representative security token asset that is linked to that specific fund. That token can be redeemed at Net Asset Value for the equivalent amount of donor cryptocurrency, such as ETH.

Portfolio Managers (PMs) are required to stake SNOW tokens in order to create and run a fund on the platform. PM’s are compensated based on performance, exclusively in SNOW. The Smart Contract tracks performance and enforces payouts and specific vesting periods for all compensation paid out.

Once we finalized the token model approach, we were able to overlay the core thesis of the project into a complete picture to formulate the business plan. Our approach was then to back this with a complete picture of the issues that exist today with respect to the competitive landscape. We then described how our client’s platform systematically addressed each of these issues. Finally we incorporated a study of the market size to drive the argument home. This was elegantly packaged into an expertly written whitepaper.

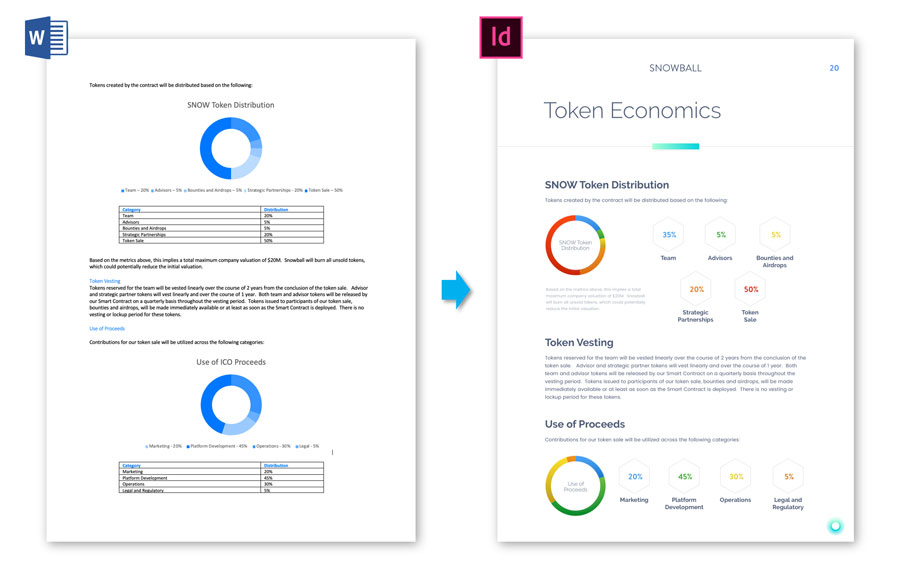

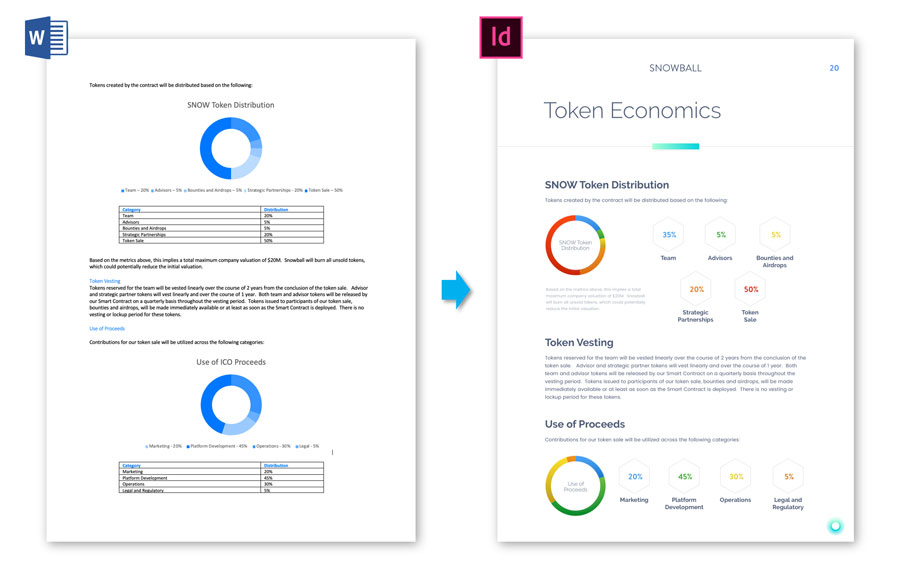

All of our whitepapers start off as an outline, before they are crafted into 12-18 page Microsoft Word document. After successive rounds of drafts, discussions and revisions, a final version is produced. From there it is carefully laid out, creatively designed and composed in Adobe InDesign, before it becomes a PDF that can be published on your website. Our process is distilled into a careful series of steps meant to capture the uniqueness of your blockchain project, your value proposition, and ultimately why someone should contribute to your project.